Welcome everyone to the Sep’25 edition of The RISK VANTAGE, your monthly publication featuring thought pieces on complex topics in risk management and quantitative finance, regular insights on AI/ML developments, and practical tips for navigating global careers.

Authored by Manoj Rathi (https://manojrathi.com/about/)

Ready to fast-track your risk management career? Complete my assessment to discover your readiness level and unlock personalized guidance : [https://manojrathi.com/risk-career-assessment/]

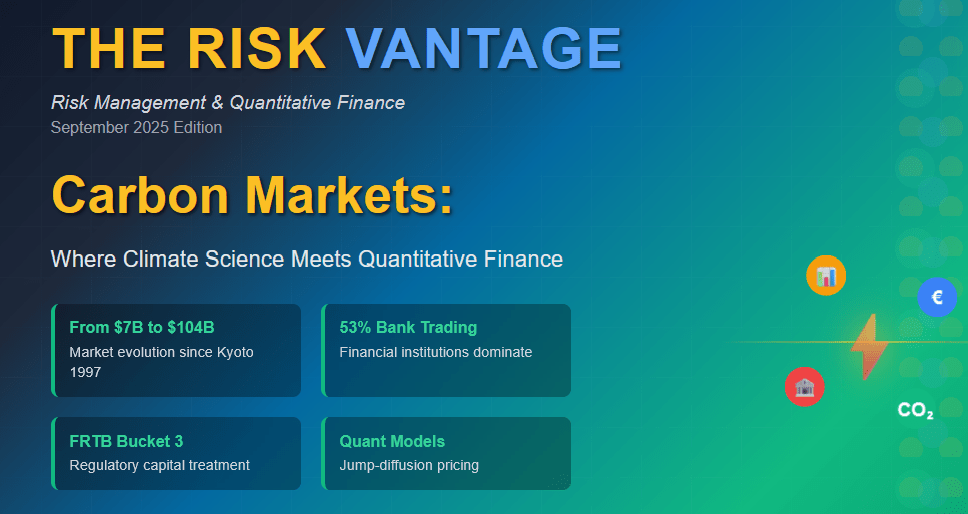

The journey of Carbon from environmental policy tool to a tradable asset began with the 1997 Kyoto Protocol’s cap-and-trade mechanism. What policymakers designed as a regulatory framework accidentally created the conditions for a new financial market. The combination of regulated supply reduction, economic activity-driven demand, and low correlation with traditional assets created a compelling asset that offers portfolio benefits and cater to the needs of the smart Investors.

For Risk and Quant professionals, carbon markets represent both opportunity and necessity. The rapid growth in market sophistication creates demand for advanced modelling capabilities, while the integration of climate considerations into financial decision-making makes carbon literacy increasingly essential.

Carbon as an Asset Class

Carbon exhibits the fundamental characteristics that define any asset class:

· It represents a store of value.

· Generates measurable returns

· Provides portfolio diversification benefits

· Trades in liquid markets

But what makes Carbon differ from traditional assets is its uniqueness:

Carbon operates under a “regulatory scarcity model” where government policy, not market forces, controls supply. Unlike gold or oil where scarcity is geological, carbon scarcity is deliberately engineered through declining emission caps. This creates predictable supply reduction (EU cap decreases 4.3% annually) while demand fluctuates with economic activity, generating systematic arbitrage opportunities that quantitative professionals can exploit.

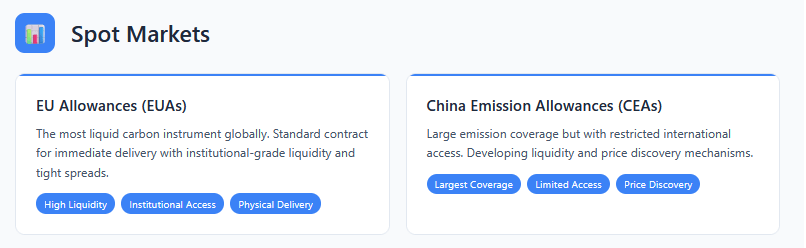

Carbon Market Products and Instruments:

The carbon market ecosystem encompasses various instruments catering to different investor needs and risk profiles with the most popular ones include:

The Market Players: Who’s Trading Carbon?

The Institutional Dominance

Financial institutions dominate carbon trading, not the companies actually emitting carbon.

In the EU’s carbon market:

- Investment firms and banks: 53% of derivative positions

- Non-covered companies: 26%

- Actual polluting companies: Only 15%

Banks act as intermediaries, helping companies manage their carbon costs while seeking profits from price movements.

Major investment banks have established dedicated carbon trading desks generating significant revenues. Banks earn through multiple streams: bid-ask spreads , intermediation fees , and structured product margins. With EU carbon markets generating €183.6 billion annual turnover, even modest market share translates to substantial revenue.

Retail Investors: Limited but Growing

Most carbon markets don’t allow individual investors to trade directly. However, retail participation is growing through:

- Carbon ETFs like KraneShares Global Carbon Strategy ETF (KRBN).

- Low-carbon equity funds that invest in companies with smaller carbon footprints.

The numbers tell the transformation story: carbon markets that barely existed in 2005 now generate more annual trading volume than most sovereign bond markets, with financial institutions capturing 53% of all trading activity while the actual polluting companies account for just 15%.

Carbon Pricing and Valuation:

Carbon markets present unique modelling challenges that traditional asset pricing frameworks struggle to capture.

Traditional Black-Scholes fails in carbon markets due to regime-switching volatility and policy jumps.

These instruments require modelling the forward curve under various regulatory scenarios (Regulatory announcements can move carbon prices 20-30% in a single day) while accounting for banking provisions, borrowing restrictions, and vintage-specific trading rules. The mathematics involve path-dependent payoffs where current decisions affect future option availability.

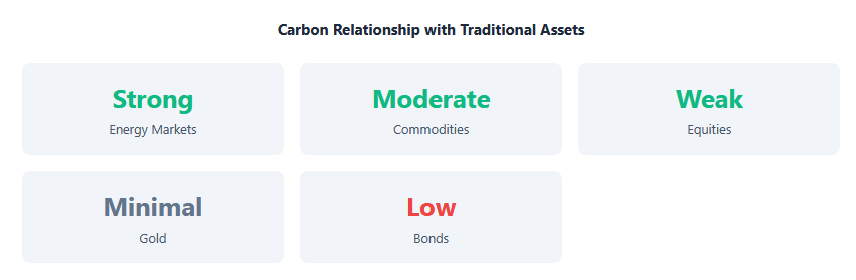

On the other side Carbon markets exhibit predictable seasonal patterns as companies up their emissions, creating systematic opportunities for quantitative strategies. Correlation analysis between carbon prices and other risk factors is becoming critical for portfolio construction and for better diversification purpose. At same time Standard risk models underestimate how volatile these markets can be. Monte Carlo simulations need to account for policy changes alongside market forces.

Parting Thoughts:

Carbon markets are transitioning from regulatory compliance tools to a recognized asset class. While challenges remain, the trajectory is clear: Carbon is becoming a permanent feature of the global financial landscape. The successful navigation of carbon markets requires understanding their unique characteristics while adapting traditional portfolio management and risk frameworks to accommodate their distinctive risk-return profile. As carbon markets mature and expand further, they are likely to become a permanent fixture in institutional investment portfolios and risk management frameworks.

The question isn’t whether carbon becomes a permanent asset class – it’s whether as Risk and Quant professional we are positioned to capitalize on the transition.

References and further publication to deep dive for those interested in the subject:

- ISDA (2023) Carbon Derivatives: Definitions and Valuation Guidelines.

- ESMA (2024) EU Carbon Markets Analysis: Trading Patterns and Price Discovery.

- Bank of England (2023) Climate Scenario Analysis: Carbon Price Assumptions and Methodologies.